Chapter 03: How Digital Media Is Bought, Sold and Measured

Digital media buying has undergone a remarkable transformation over the past two decades. What once relied on direct, manual negotiations between advertisers and publishers has evolved into a highly sophisticated ecosystem where programmatic transactions occur in milliseconds.

In this chapter, we’ll look at the main ways digital advertising is bought, sold and measured.

Key takeaways

- Digital media buying has evolved from direct, manual deals to sophisticated programmatic transactions that happen in milliseconds.

- The four main programmatic buying methods include programmatic direct, programmatic guaranteed, real-time bidding (RTB), and header bidding.

- Real-time bidding revolutionised digital advertising by creating auction-based systems where impressions are sold to the highest bidder in real-time.

- Header bidding emerged as a solution to the inefficiencies of the traditional waterfall method, giving publishers more control and better yields.

- Digital media measurement revolves around key metrics like impressions, clicks, and conversions, with pricing models including CPM, CPC, and CPA.

- Measurement approaches vary by environment, with web advertising offering more standardised tracking compared to emerging channels like connected TV (CTV).

Before we dive into the intricacies of modern programmatic advertising, it’s worth understanding how digital media buying has evolved. This evolution reflects the industry’s constant push toward greater efficiency, better targeting, and improved return on investment.

From insertion orders to automation: The early days

At the dawn of digital advertising (1994-2000), buying ad space online mirrored traditional media buying.

Advertisers or their agencies would:

- Identify websites with audiences they wanted to reach

- Contact publishers directly to negotiate placements

- Exchange insertion orders (IOs) – contractual documents specifying ad sizes, placements, timing, and costs

- Manually send creative assets to publishers

- Receive performance reports after campaigns ended

This process was labor-intensive, slow, and inefficient. Each publisher had different specifications, pricing structures, and reporting methods.

Campaigns across multiple websites required separate negotiations and contracts, making it difficult to coordinate timing or compare performance.

The introduction of ad servers in the mid-1990s (as we saw in Chapter 1 with FocaLink Media Services) began to streamline this process. Ad servers allowed for centralised ad delivery and measurement, but the buying process itself remained largely manual.

As the Internet grew, so did the number of websites offering ad inventory. This expansion made direct buying increasingly impractical for both advertisers—who couldn’t negotiate with thousands of sites—and publishers—who couldn’t maintain direct relationships with every potential advertiser.

This inefficiency created the perfect conditions for intermediaries—ad networks—to emerge, aggregating inventory from multiple publishers and selling it in bulk to advertisers.

While this improved scale, it introduced new challenges around transparency and control.

The true revolution came in the late 2000s with the introduction of real-time bidding (RTB)—the use of automated systems and data to buy and sell digital ads in real time.

The main ways digital media can be bought and sold

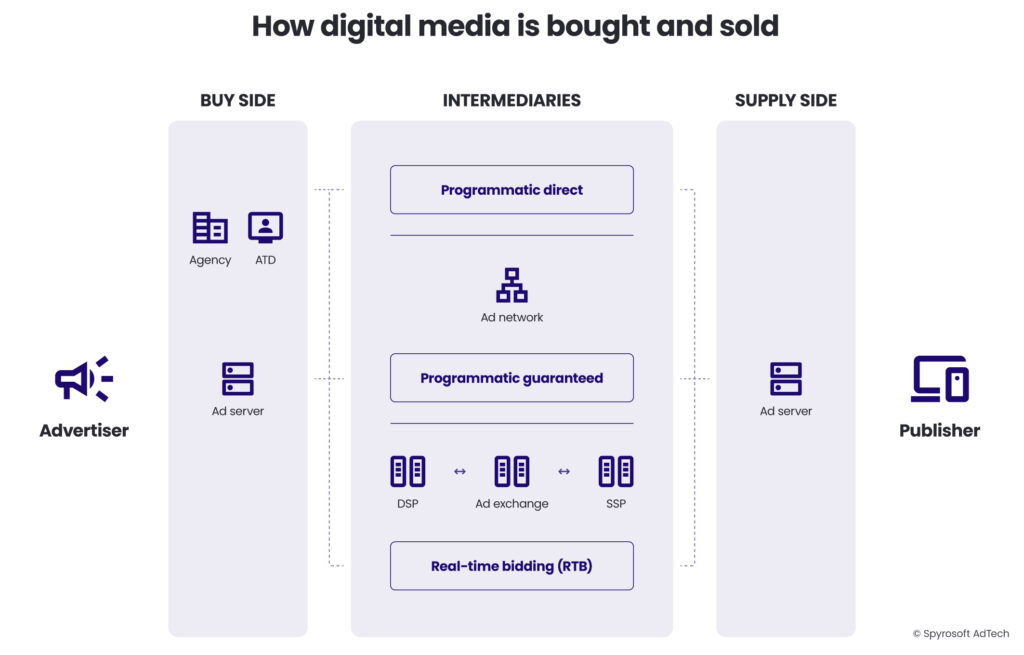

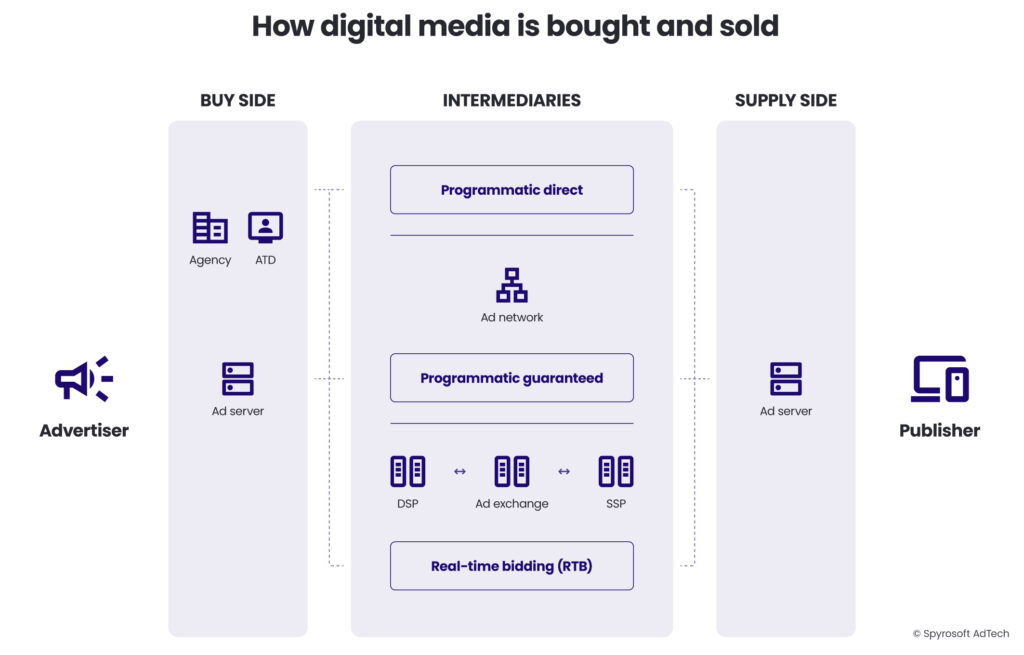

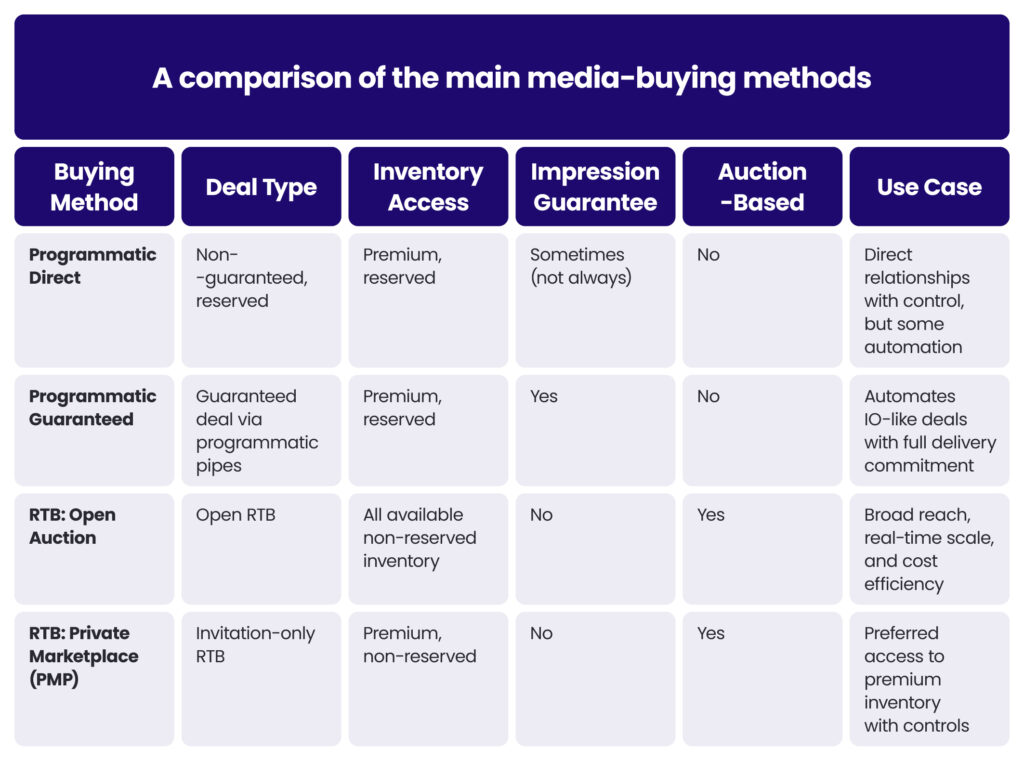

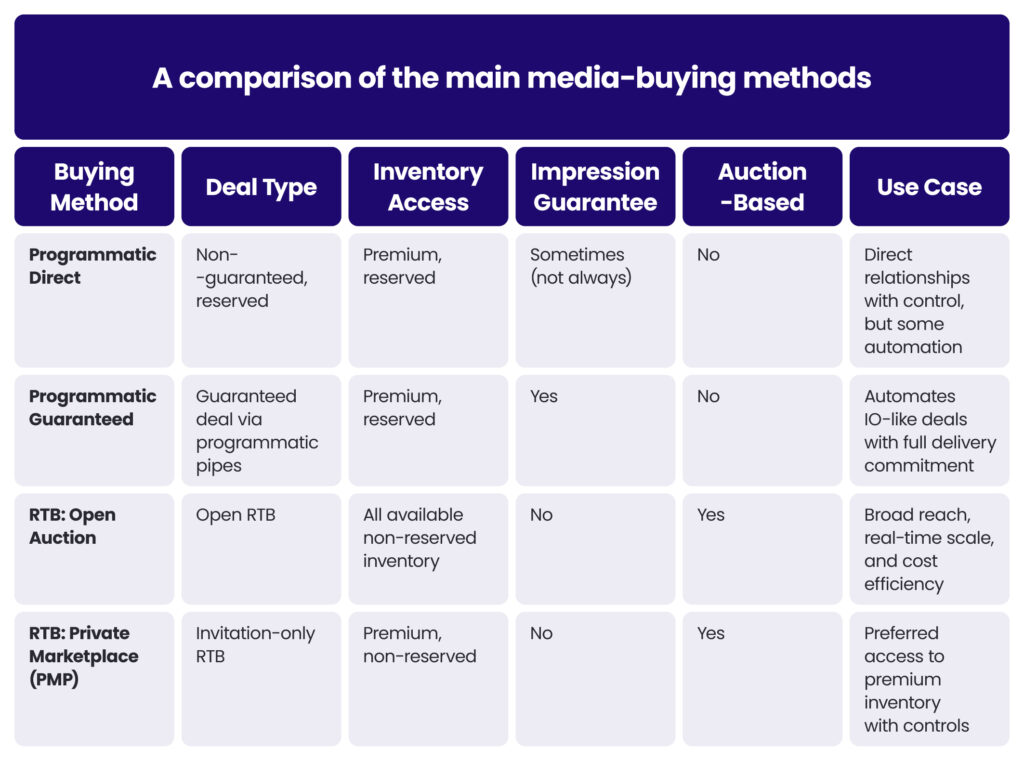

Today’s digital media landscape offers multiple buying methods, each with distinct advantages and use cases. These methods can be visualised as a spectrum from highly controlled, direct and guaranteed placements to fully automated, auction-based transactions.

The primary media-buying methods in programmatic advertising

Programmatic advertising encompasses several transaction types, each serving different advertiser needs and campaign objectives.

The main programmatic buying methods include:

Programmatic direct: Fixed-price, non-auction-based transactions negotiated directly between advertisers and publishers, but executed through programmatic technology.

Programmatic guaranteed: A commitment to deliver a specific number of impressions at a guaranteed price, combining the certainty of traditional direct buys with programmatic efficiency.

Real-time bidding (RTB): Auction-based buying where ad impressions are sold individually to the highest bidder at the moment a user loads a page.

Let’s examine each method in detail to understand their mechanics, advantages, and appropriate use cases.

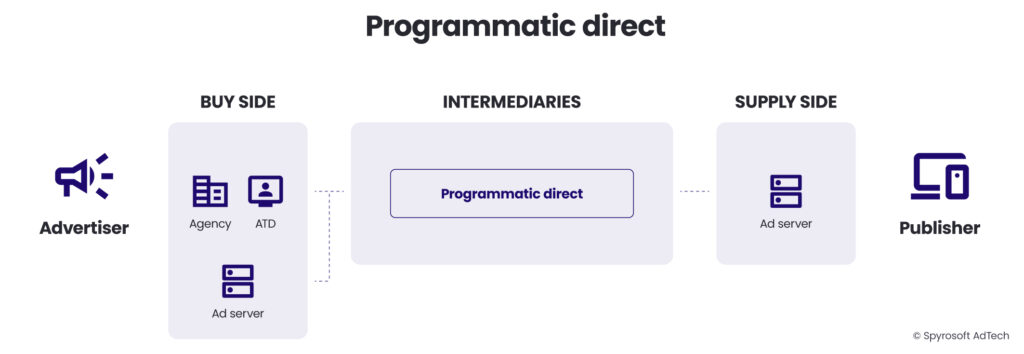

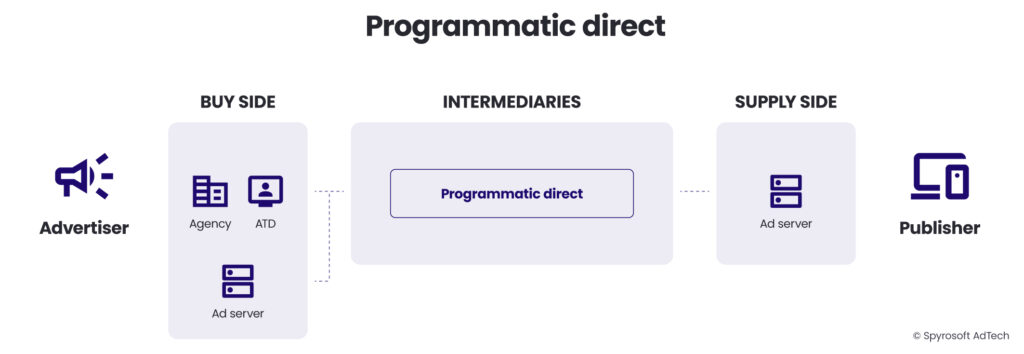

Programmatic direct

Programmatic direct combines the certainty of traditional direct buys with the efficiency of programmatic technology.

In this model, advertisers and publishers negotiate terms directly, but the execution happens through automated systems.

How it works

- The advertiser and publisher negotiate terms directly, including placement, price, and volume.

- Instead of sending insertion orders and creatives manually, the campaign details are entered into a programmatic platform, such as an ad server.

- Ad serving, targeting, and reporting are handled automatically through the platform.

Benefits

- Premium inventory access: Secures prime placements that might not be available in open auctions.

- Brand safety: Greater control over where ads appear.

- Pricing predictability: Fixed CPMs make budgeting more accurate.

- Reduced administrative overhead: Eliminates manual trafficking and reporting.

Programmatic direct is particularly valuable for brand campaigns requiring specific placements, such as homepage takeovers, sponsored content integrations, or high-impact rich media formats.

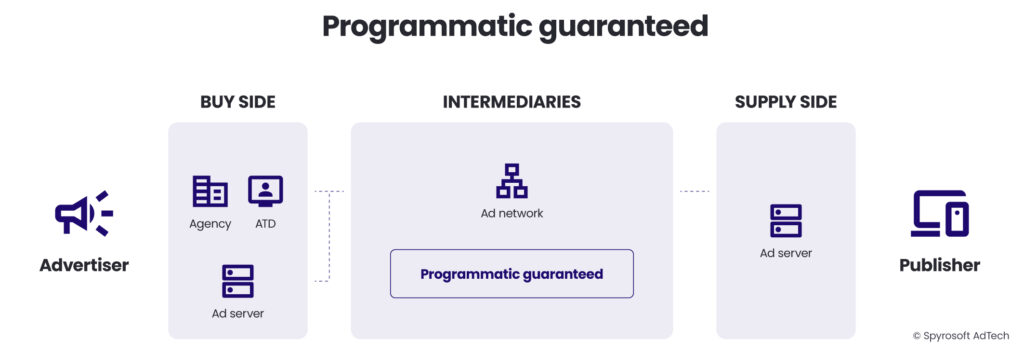

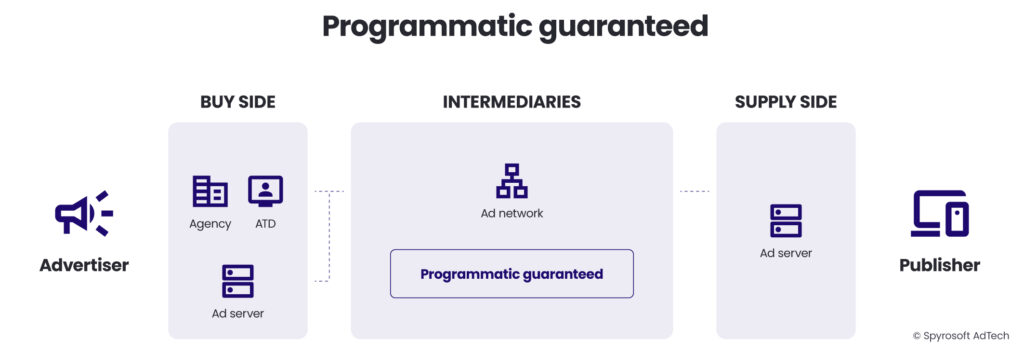

Programmatic guaranteed

Programmatic guaranteed (also called “automated guaranteed” or “programmatic reserved”) takes programmatic direct a step further by guaranteeing a specific volume of impressions.

How it works

- Advertisers commit to purchasing a set number of impressions at a fixed CPM.

- Publishers guarantee delivery of those impressions to the specified audience.

- The entire process—from deal negotiation to delivery and reporting—occurs through programmatic platforms.

Benefits

- Guaranteed inventory: Guarantees access to premium inventory that might otherwise be unavailable.

- Audience targeting: Combines the certainty of direct buys with the audience precision of programmatic.

- Predictable costs: Fixed pricing enables accurate forecasting.

- Reliable planning: Guaranteed delivery allows for more reliable planning, especially for time-sensitive campaigns.

Programmatic guaranteed is ideal for campaigns with fixed budgets, specific timing requirements (like product launches or holiday promotions), and situations where reaching a particular audience is non-negotiable.

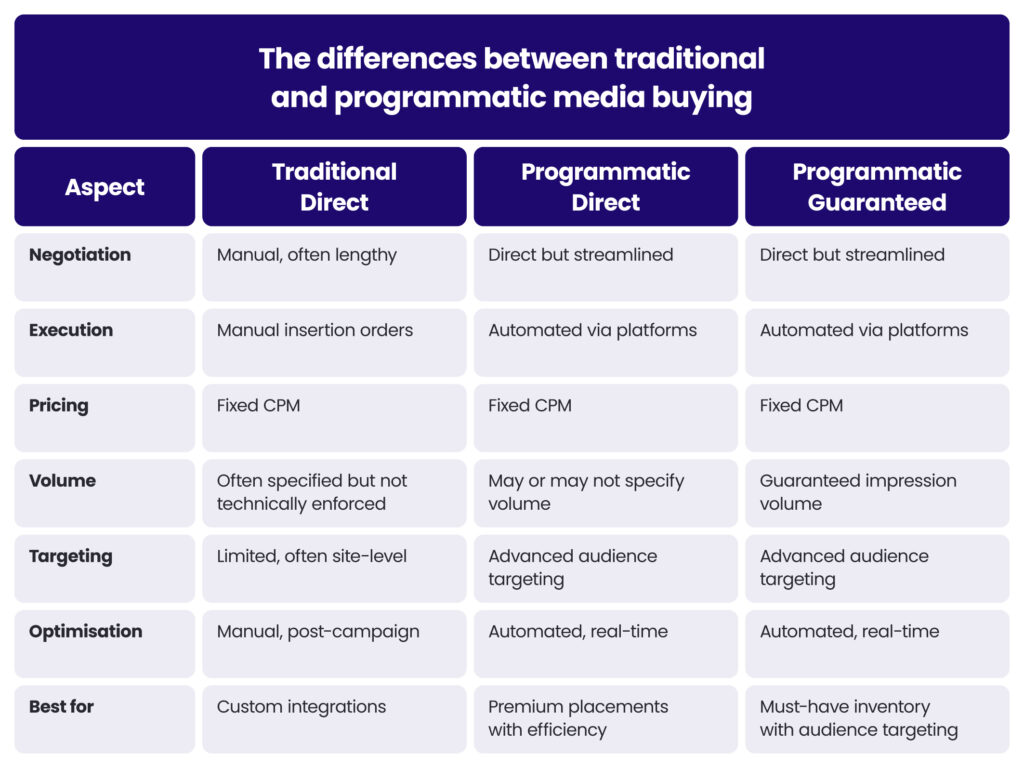

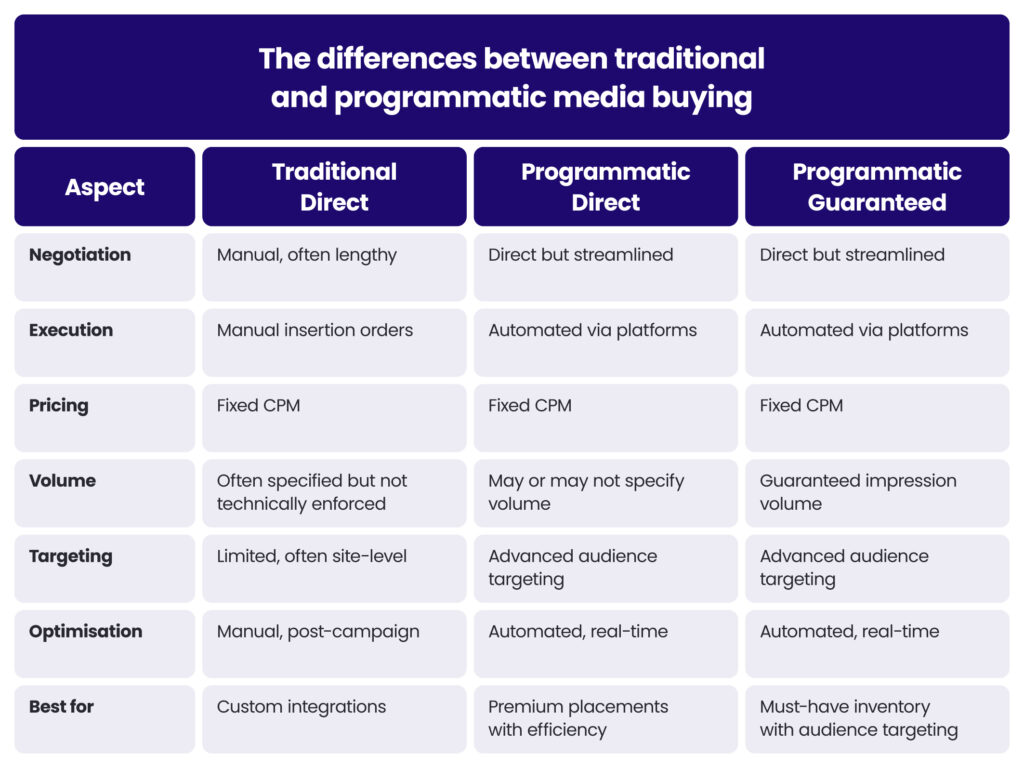

The table below illustrates the key differences between traditional direct buying and its programmatic evolutions:

Programmatic direct deals are commonly associated with high-profile publishers—such as Forbes or The Wall Street Journal—who set aside a portion of their ad inventory that they choose not to make available on the open exchange. This reserved inventory can command higher prices from advertisers in exchange for guaranteed placement.

Real-time bidding (RTB): The auction revolution

Real-time bidding introduced a fundamental shift in how digital ads are bought and sold. Instead of pre-negotiated deals, RTB created auction-based systems where each impression is sold to the highest bidder the moment a user loads a page.

How it works

- A user visits a webpage with an ad slot.

- The publisher’s supply-side platform (SSP) sends a bid request to multiple ad exchanges.

- The exchanges forward the request to demand-side platforms (DSPs).

- DSPs evaluate the impression based on the advertiser’s targeting criteria and bid accordingly.

- The highest bid wins, and the winning ad is displayed to the user.

- The entire process takes place in milliseconds.

This auction mechanism introduced unprecedented efficiency and targeting precision to digital advertising. Instead of buying impressions in bulk, advertisers could now evaluate and bid on each impression individually based on user data, context, and campaign goals.

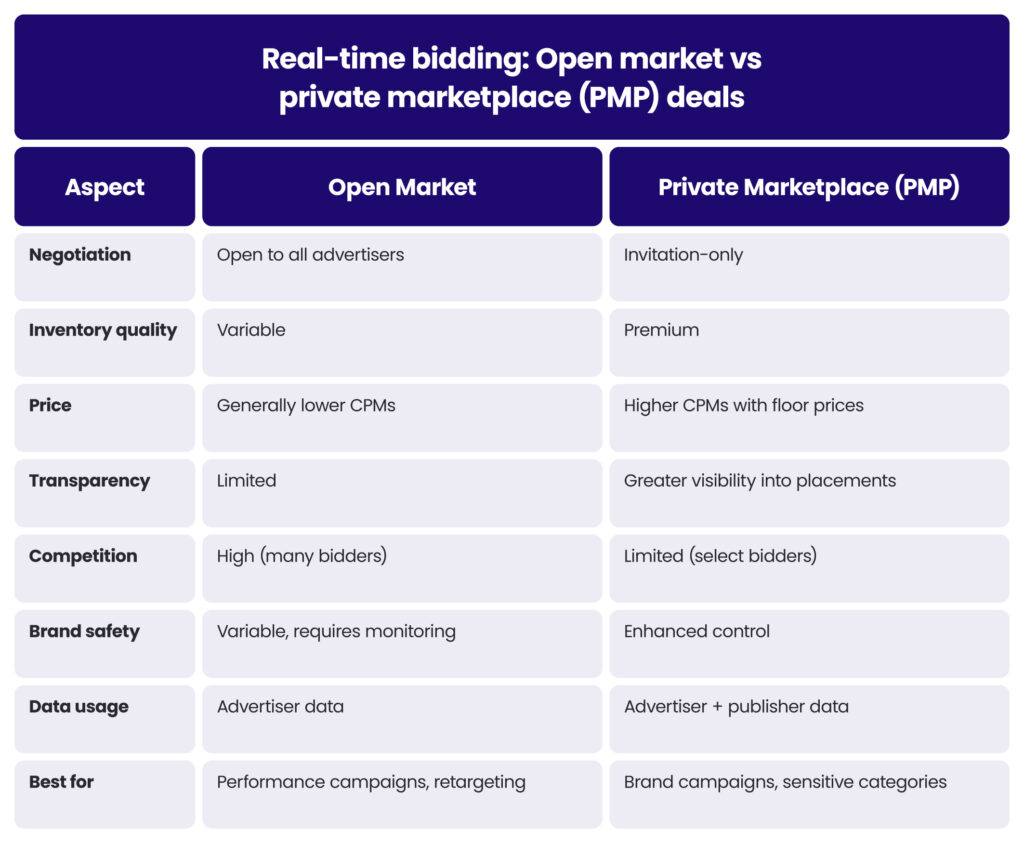

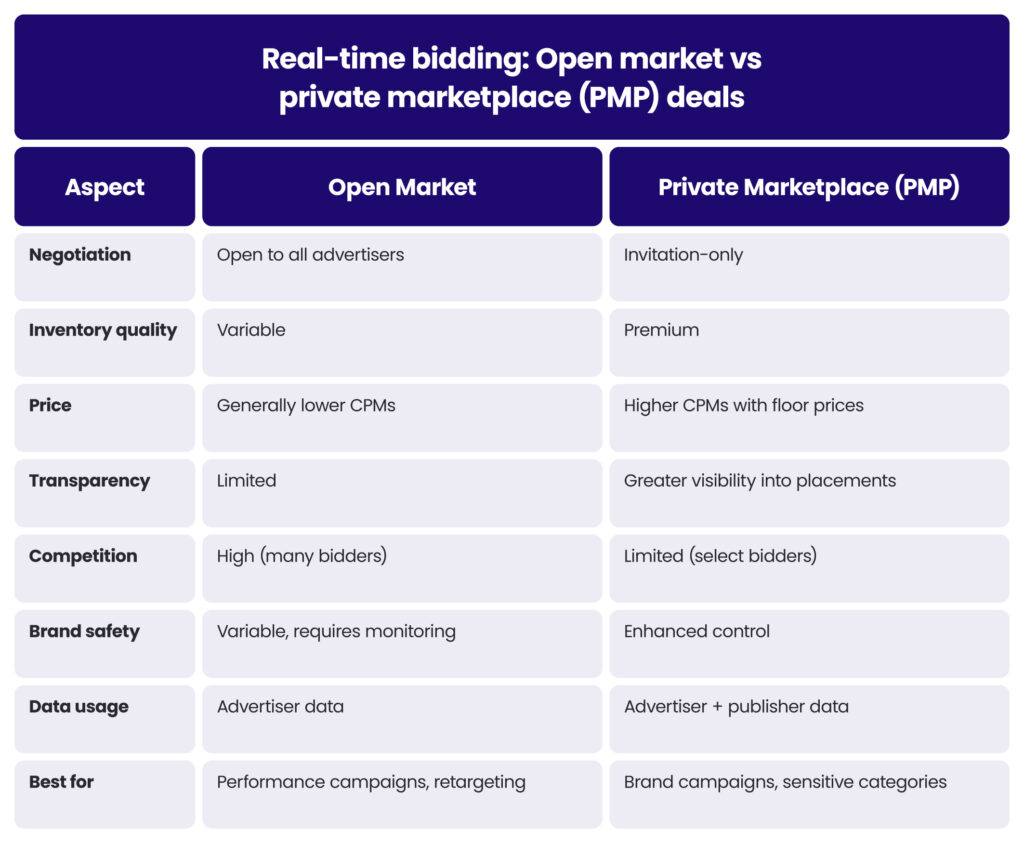

RTB transactions typically fall into two categories: open market and private marketplace (PMP).

Open market

The open market (also called the “open exchange” or “open auction”) is the most accessible form of programmatic buying. It’s a massive marketplace where any advertiser can bid on available inventory across thousands of publishers.

Characteristics of open market RTB:

- Accessibility: Low or no minimum spend requirements.

- Scale: Access to billions of impressions across the web.

- Competitive pricing: Dynamic auction-based pricing, often resulting in lower CPMs.

- Variable quality: Inventory quality and brand safety can vary widely.

Open market RTB is particularly useful for performance-focused campaigns, retargeting, and advertisers looking to maximise reach while optimising for specific actions like clicks or conversions.

Private marketplace (PMP): Invitation-only auctions

Private marketplaces offer a middle ground between the open market and guaranteed deals.

They’re invitation-only auctions where selected advertisers can bid on premium inventory that publishers don’t make available in the open market.

Top-tier publishers frequently work with well-known brands through private marketplace deals as they can secure a higher price for their premium inventory. From the advertiser’s perspective, this setup is attractive because it offers more transparency and assurance about where their ads will appear.

How it works

- Publishers create “packages” of premium inventory.

- Selected advertisers receive deal IDs that grant access to these packages.

- When a user visits a page, the publisher first checks if any PMP buyers want the impression before sending it to the open market.

- The auction occurs among the invited buyers, often with a predetermined floor price.

Benefits

- Premium inventory access: Reaches inventory not available in open auctions.

- Reduced competition: Fewer bidders mean better chances of winning impressions.

- Brand safety: Greater control over where ads appear.

- Data overlays: Ability to combine publisher data with advertiser data for superior targeting.

PMPs are ideal for brand campaigns requiring quality placements, advertisers in sensitive categories (like finance or healthcare), and campaigns targeting specific high-value audiences.

The table below summarises the key differences between the open market and PMPs:

Key points about the 3 main media-buying processes:

- Programmatic Direct often resembles traditional direct buys but is executed through automated platforms. There’s no guaranteed delivery unless specifically arranged.

- Programmatic Guaranteed provides the highest certainty for both buyers and sellers, combining the benefits of traditional direct deals with automation.

- PMPs are invite-only auctions, giving advertisers access to curated, premium inventory before it goes to the open market.

- Open RTB is the most dynamic and scalable option, but comes with less control and greater competition.

Waterfalls and header bidding

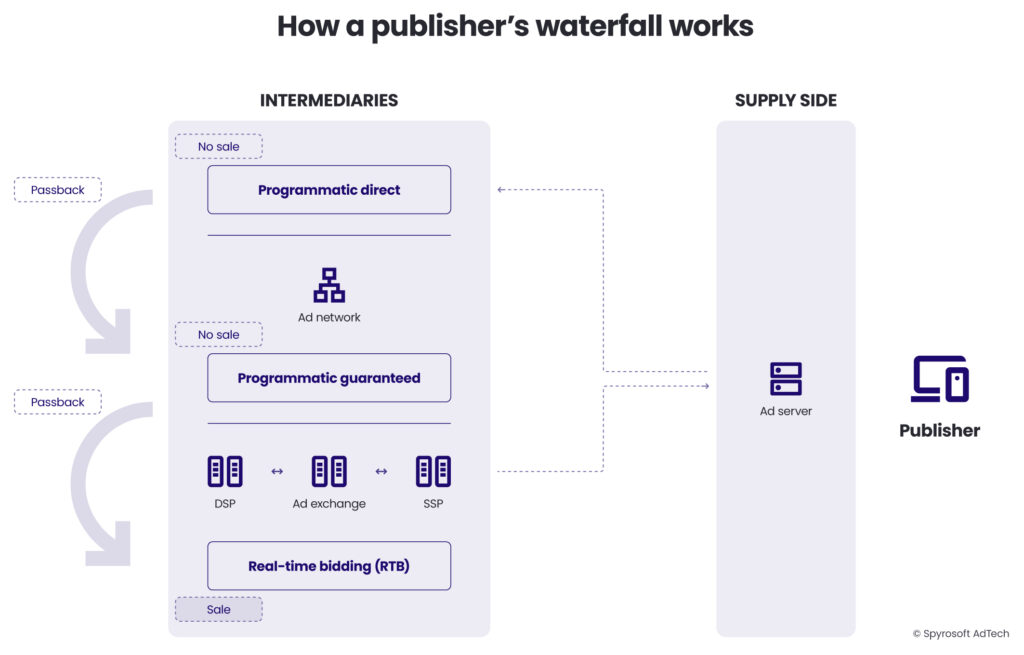

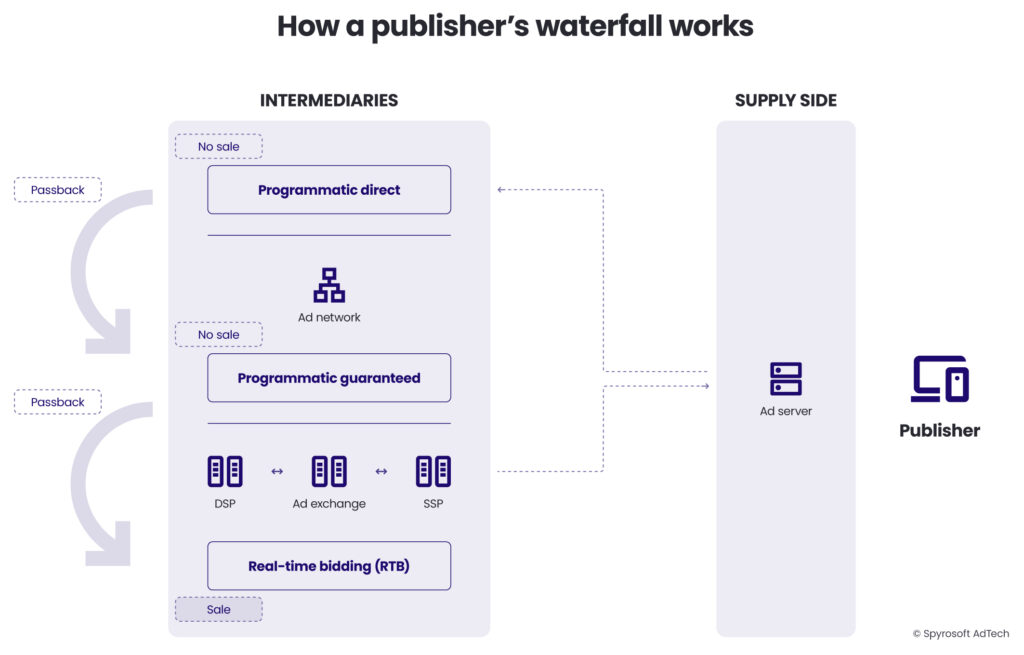

The waterfall process in programmatic advertising is an early method used by publishers to prioritise and fill ad inventory by calling demand sources sequentially based on their estimated performance or historical CPMs.

In this setup, a publisher would offer an impression to their top-ranked ad network first. If that network didn’t fill the impression, it would then be passed down to the next network in the priority list, and so on—hence the term “waterfall.”

This process emerged before the rise of real-time bidding (RTB) and was widely used as a way to maximise fill rates while maintaining some control over yield.

However, it lacked transparency and often led to inefficiencies, as lower-priority bidders never had a chance to compete for impressions they might have valued more highly than those offered first.

These issues led to the creation of header bidding.

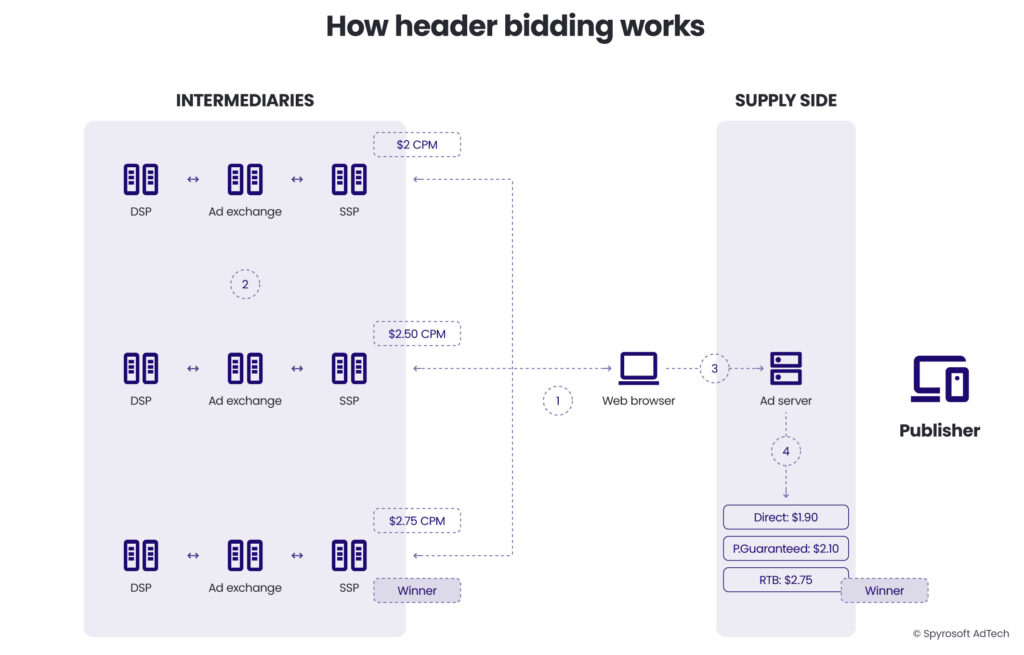

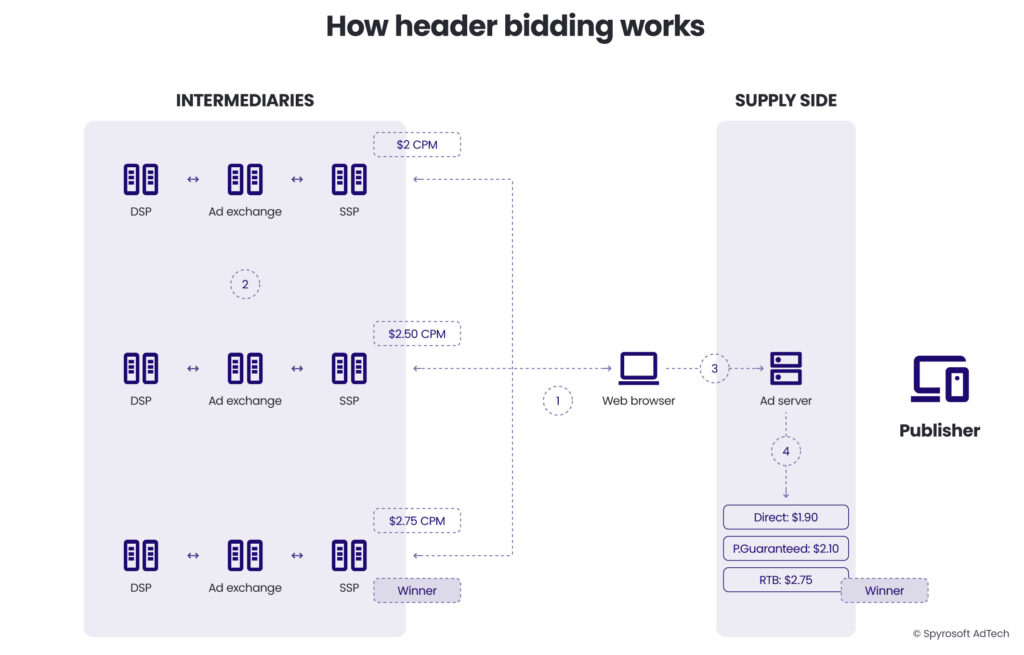

Header bidding: Democratising the auction

Header bidding emerged as a technical innovation to address inefficiencies in the traditional “waterfall” method of programmatic selling and to combat Google’s preference of its ad exchange.

To understand header bidding, we first need to understand the problem it solved.

The waterfall problem

Traditionally, publishers used a sequential approach (aka the “waterfall” or “daisy chain”) to sell their inventory.

The process would work like this:

- The publisher’s ad server receives an ad request from a web page.

- The ad server loads the first demand source, e.g. a programmatic direct deal.

- If there is no match – e.g. if there isn’t a matching campaign – then the ad request is forwarded to the next demand source in the queue. This process is known as a passback.

- This process continues until a demand partner buys the inventory. The ad creative is then displayed to the Internet user.

- If none of the demand sources purchase the inventory, then the publisher will likely show an in-house ad.

This sequential process created several problems:

- Revenue loss: Ad networks further down in the chain might have been willing to pay more than earlier ones, but never got the chance to bid.

- Google preference: Google Ad Manager (formerly DoubleClick for Publishers) typically gave preference to Google’s own AdX exchange, potentially reducing competition.

- Latency: The sequential calls to multiple networks increased page load times.

- Passback inefficiency: If a network couldn’t fill the impression, it would be “passed back” to the publisher, creating additional delays.

How header bidding works

Header bidding revolutionised this process by allowing publishers to offer their inventory to multiple ad exchanges simultaneously before making calls to their ad servers.

The process works as follows:

Step 1

- Publishers add JavaScript code to the header section of their webpages.

- When the webpage loads, the header bidding JavaScript code sends a request to the various demand partners, e.g. DSPs via ad exchanges and SSPs.

Step 2

- A real-time bidding auction is held and the DSPs place their bids.

Step 3

- The highest bid from the RTB auctions is sent to the publisher’s ad server.

Step 4

- The ad server can then compare this bid against direct campaigns and other demand sources.

- The demand source with the highest price wins and the ad is served to the Internet user.

Benefits of header bidding:

- Increased revenue: By soliciting bids from multiple sources simultaneously, publishers can capture the true market value of each impression.

- Greater transparency: Publishers gain visibility into the value of their inventory across demand sources.

- Reduced Google dependency: Publishers can include multiple exchanges, reducing reliance on Google’s AdX.

- Improved fill rates: With more bidders competing, fewer impressions go unfilled.

Since its introduction around 2015, header bidding has become the standard for programmatic selling among sophisticated publishers, though it requires technical expertise to implement and optimise properly.

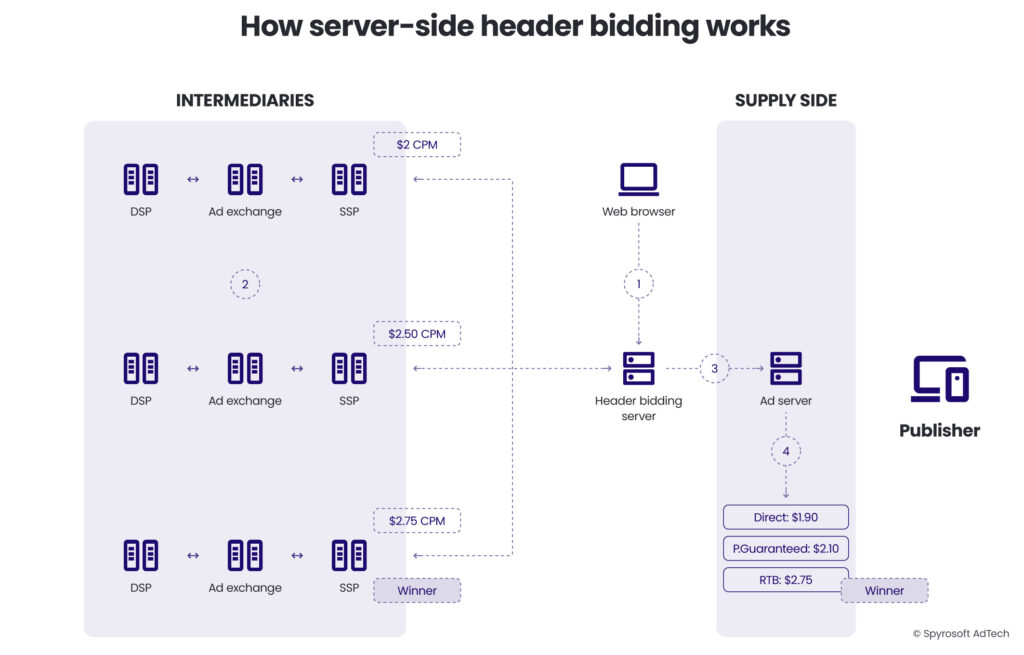

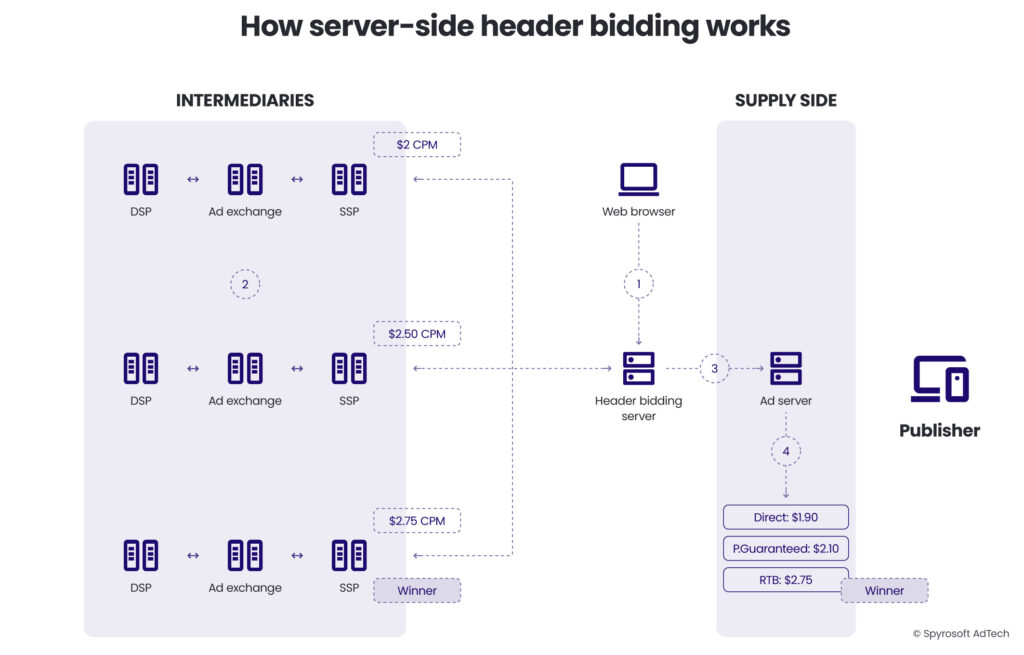

Server-side header bidding: The next evolution

As header bidding gained popularity, concerns about page latency emerged due to multiple JavaScript calls from the browser.

Server-side header bidding addresses this by moving the auction process to an external server.

Here’s how the server-side heading bidding process works:

- The publisher’s page loads the header bidding script and makes a single call to the header bidding server.

- A real-time bidding auction is held and the DSPs place their bids.

- The highest bid from the RTB auctions is sent to the publisher’s ad server.

- The ad server can then compare this bid against direct campaigns and other demand sources. The demand source with the highest price wins and the ad is served to the Internet user.

This approach reduces latency but can introduce challenges with cookie matching and user identification. Many publishers now use hybrid approaches, with some partners called client-side and others server-side.

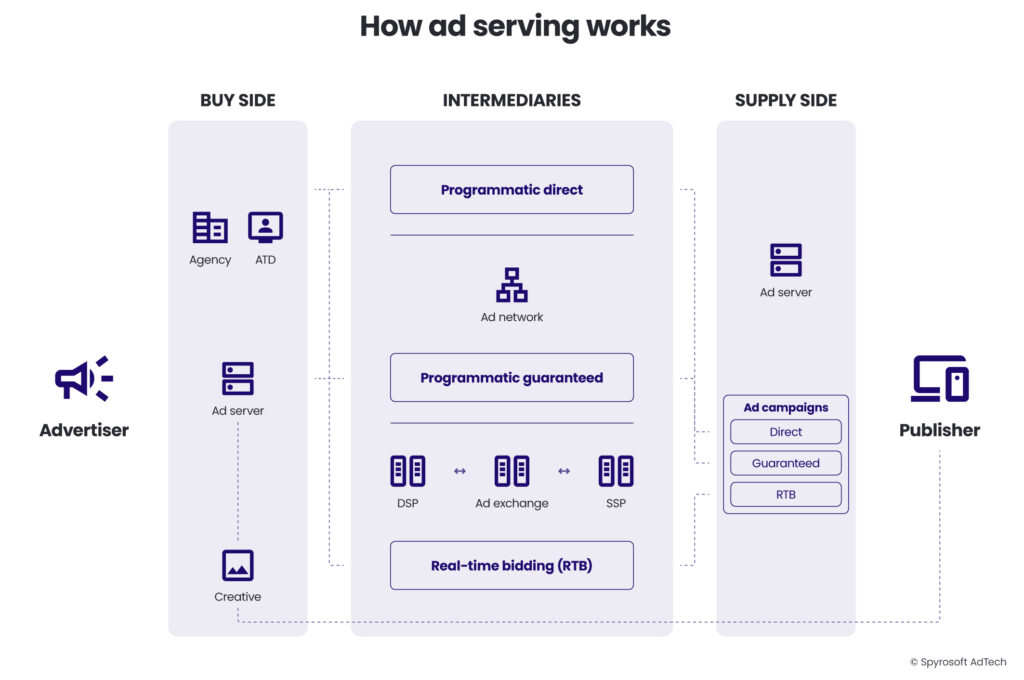

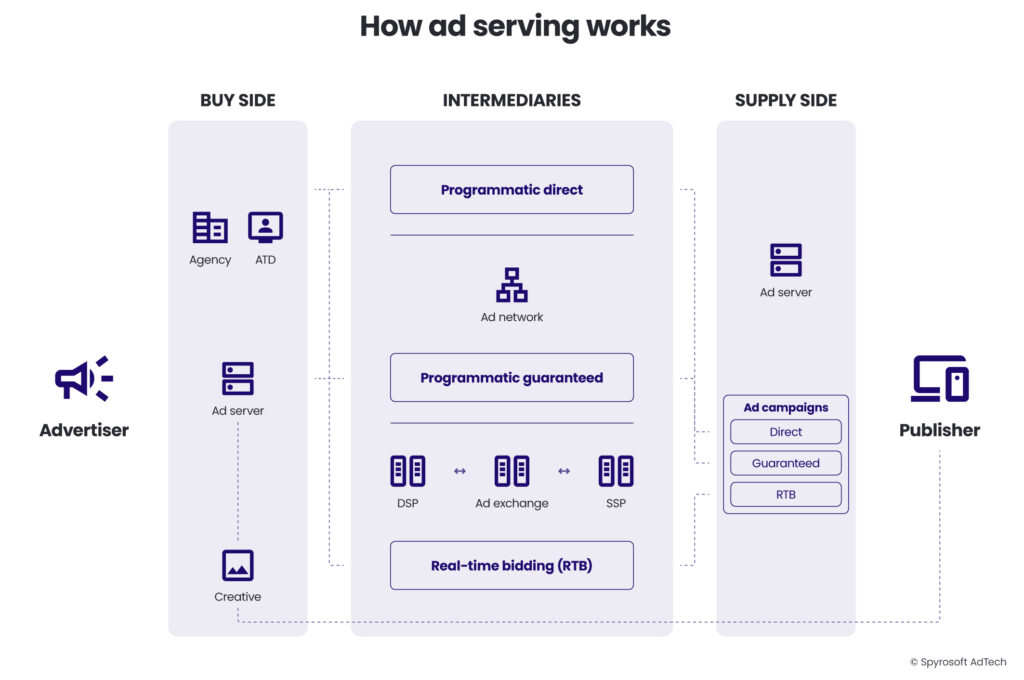

How ads are served to the end user

Once a buying method is selected and a transaction occurs, the ad must be delivered to the user’s device. This process, known as ad serving, is the technical backbone of digital advertising.

The ad serving process

Ad serving is the technology and process that places advertisements on websites, apps, or other digital platforms. It’s responsible for selecting the right ad to show, delivering it to the user’s device, and tracking performance metrics.

The ad serving process follows these steps:

- A user visits a website with an ad slot.

- The publisher’s ad server receives a request to fill that slot.

- Based on targeting parameters and available campaigns, the ad server selects an appropriate campaign, e.g. programmatic direct, programmatic guaranteed, or RTB.

- The ad request is then passed to the relevant AdTech platforms.

- The advertiser’s ad server receives the ad request from the relevant AdTech platform and sends the ad creative to the publisher’s website and displays it to the Internet user.

- The impression is recorded, and the user interaction (view, click, etc.) is tracked.

Ad tags: The technical connectors

Ad tags are snippets of code that publishers place on their websites to display ads. These tags serve as the technical bridge between publishers, ad servers, and advertisers.

Several types of ad tags are used in modern digital advertising:

JavaScript tags

JavaScript tags are the most versatile and commonly used ad tags. They allow for dynamic ad selection, user interaction tracking, and can support rich media functionality.

<script src="https://ad.server.com/ad?zone=homepage&size=300x250"></script>JavaScript tags offer several advantages:

- Support for dynamic content and interactive features

- Ability to detect browser characteristics for targeting

- Support for viewability measurement

- Compatibility with most ad formats

However, they can impact page load performance and may be blocked by ad blockers.

Iframe tags

Iframe (inline frame) tags load ad content in a separate HTML document displayed within the publisher’s page. This creates a boundary between the publisher’s content and the ad:

<iframe src="https://ad.server.com/ad?zone=sidebar&size=160x600" width="160" height="600" frameborder="0"></iframe>Iframes provide important benefits:

- Security isolation between the publisher page and ad content

- Prevention of CSS or JavaScript conflicts

- Containment of potentially resource-intensive ad code

The main disadvantage is limited interaction between the ad and the main page, restricting some targeting and measurement capabilities.

SafeFrame

SafeFrame is an IAB standard that evolved from basic iframes. It provides a controlled environment for ads while allowing certain approved interactions with the main page:

<iframe src="https://ad.server.com/ad?zone=content&size=300x250" width="300" height="250" frameborder="0" data-safeframe="true"></iframe>SafeFrame offers a balance of security and functionality:

- Controlled access to specific page information (like viewport position)

- Support for rich media expansion without disrupting page content

- Standard viewability measurement

- Protection from malicious code

Image tags

Image tags are the simplest form of ad tags, displaying basic image-based ads:

<img src="https://ad.server.com/ad?zone=footer&size=728x90" width="728" height="90" alt="Advertisement" />While limited in functionality, image tags offer advantages in certain situations:

- Fast loading times

- High compatibility across browsers and devices

- Less likely to be blocked by ad blockers

- Minimal impact on page performance

Their main limitation is the lack of support for tracking beyond the initial impression and click.

Ad markup: Standard formats for consistency

To ensure interoperability across the digital advertising ecosystem, standard ad markup formats have been developed for different ad types.

For display ads (text, image, and native)

Display ads typically use HTML5, which allows for rich, interactive experiences across devices.

The IAB has established standard specifications for common ad sizes and behaviours to ensure consistent rendering across websites.

Modern HTML5 ads often incorporate:

- Responsive layouts that adapt to different screen sizes

- CSS animations for visual appeal

- Limited JavaScript for interactivity and tracking

- Compressed assets for faster loading

Native ads require additional markup to blend seamlessly with the publisher’s content. This typically includes fields for headlines, descriptions, images, and brand attribution, structured to match the publisher’s content style.

For video and audio ads: VAST, OMID and SIMID

Video advertising relies on specific technical standards to ensure proper delivery and measurement:

VAST (Video Ad Serving Template)

VAST is an XML schema developed by the IAB to standardise communication between video players and ad servers. It provides a framework for serving video ads across different video players and platforms.

A simplified VAST response looks like this:

<VAST version="4.0">

<Ad id="1234">

<InLine>

<AdSystem>Ad Server Name</AdSystem>

<AdTitle>Summer Sale</AdTitle>

<Impression><![CDATA[https://ad.server.com/impression]]></Impression>

<Creatives>

<Creative>

<Linear>

<Duration>00:00:30</Duration>

<MediaFiles>

<MediaFile delivery="progressive" type="video/mp4" bitrate="500" width="640" height="360">

<![CDATA[https://ad.server.com/videos/ad.mp4]]>

</MediaFile>

</MediaFiles>

</Linear>

</Creative>

</Creatives>

</InLine>

</Ad>

</VAST>VAST handles:

- Video file locations and formats

- Companion banner ads

- Tracking URLs for various events (start, quartile completion, end)

- Clickthrough URLs

- Industry viewability and verification integrations

Open Measurement Interface Definition (OMID)

OMID is an API developed by the IAB Tech Lab that enables secure, consistent measurement of digital ad viewability, verification, and engagement—without giving third-party scripts control over the ad or media player.

SIMID (Secure Interactive Media Interface Definition)

SIMID is a video ad standard developed by the IAB Tech Lab to support secure interactive video ads—like those with clickable overlays or custom end screens—without compromising performance, user experience, or security.

Prior to OMID and SIMID, AdTech platforms would use a different standard–Video Player Ad Interface Definition (VPAID).

The goal of VPAID was to extend the capabilities of VAST by enabling interactive video ads.

However, the IAB Tech Lab started depreciating VPAID in 2019 due to security concerns and is no longer supported. Although some AdTech companies may still be using VPAID, most have migrated to VAST 4.x, OMID and SIMID.

How digital media is measured

Effective measurement is the cornerstone of digital advertising’s value proposition. Unlike traditional media, digital channels offer granular visibility into how users interact with ads, enabling performance optimisation and attribution of business outcomes.

Measurement across different environments

Measurement approaches vary significantly across digital environments due to technical differences, industry standards, and privacy considerations.

Web advertising measurement

Web advertising benefits from mature measurement standards and relatively consistent technical implementations:

Cookie-based tracking: Despite increasing limitations, cookies remain central to web measurement, enabling user journey tracking across sites.

Standard viewability metrics: The IAB defines a viewable impression as 50% of pixels in view for at least one second (two seconds for video).

Conversion tracking: Pixel-based or postback methods track user actions after ad exposure.

Attribution models: From simple last-click to complex multi-touch models, web environments offer the most robust attribution options.

Web measurement faces growing challenges from cookie restrictions, ad blockers, and privacy regulations like GDPR and CCPA, pushing the industry toward alternative measurement approaches.

Mobile app measurement

Mobile apps don’t support web cookies, relying instead on device identifiers and SDK implementations:

Mobile advertising IDs: IDFA (iOS) and GAID (Android) have traditionally enabled cross-app tracking, though Apple’s App Tracking Transparency framework has limited IDFA availability.

SDK integration: Measurement typically requires integrating software development kits into apps, creating a more fragmented landscape than web.

Install attribution: Specialised measurement focuses on app installs and post-install events, often using fingerprinting techniques when identifiers aren’t available.

In-app events: Actions like registrations, purchases, and engagement are tracked via SDK callbacks rather than pixels.

Mobile measurement is increasingly challenged by platform restrictions, particularly on iOS, where privacy changes have significantly impacted attribution capabilities.

Connected TV (CTV) measurement

Connected TV represents one of the fastest-growing digital advertising channels, but measurement remains less standardised:

Device fragmentation: Multiple platforms (Roku, Apple TV, Fire TV, smart TVs) create inconsistent measurement environments.

Limited identifiers: Traditional cookies don’t exist, and device IDs vary by platform.

Household vs. individual: CTV typically conducts measurement at the household level, making person-level attribution challenging.

Census vs. panel approaches: Measurement often combines direct device data with panel-based methods similar to traditional TV.

The industry is working toward standardised CTV measurement through initiatives like the IAB Tech Lab’s OM SDK for CTV, but comprehensive measurement remains a work in progress.

Audio advertising measurement

Digital audio, such as streaming music and podcasts, presents unique measurement challenges:

- Passive medium: Users often listen while doing other activities, making engagement harder to measure.

- Download vs. listen: For podcasts, distinguishing between downloads and actual listens remains challenging.

- Limited visual confirmation: Without visual components, confirming ad delivery requires different approaches than display or video.

- Attribution complexity: Connecting audio exposure to subsequent actions presents technical and methodological challenges.

Industry standards are evolving, with the IAB releasing measurement guidelines for podcast advertising and companies like Nielsen expanding audio measurement capabilities.

Key metrics and pricing models

Digital advertising has developed a standard set of metrics and corresponding pricing models to quantify campaign performance and establish a value exchange between advertisers and publishers.

Impression-based metrics

Impressions form the foundation of digital ad measurement, counting each time an ad is displayed to a user:

- Impressions: The total number of times an ad is served.

- Viewable impressions: Impressions that meet industry viewability standards (typically 50% of pixels in view for at least one second).

- Unique users/reach: The number of distinct individuals who saw an ad.

- Frequency: The average number of times each user saw an ad (impressions ÷ unique users).

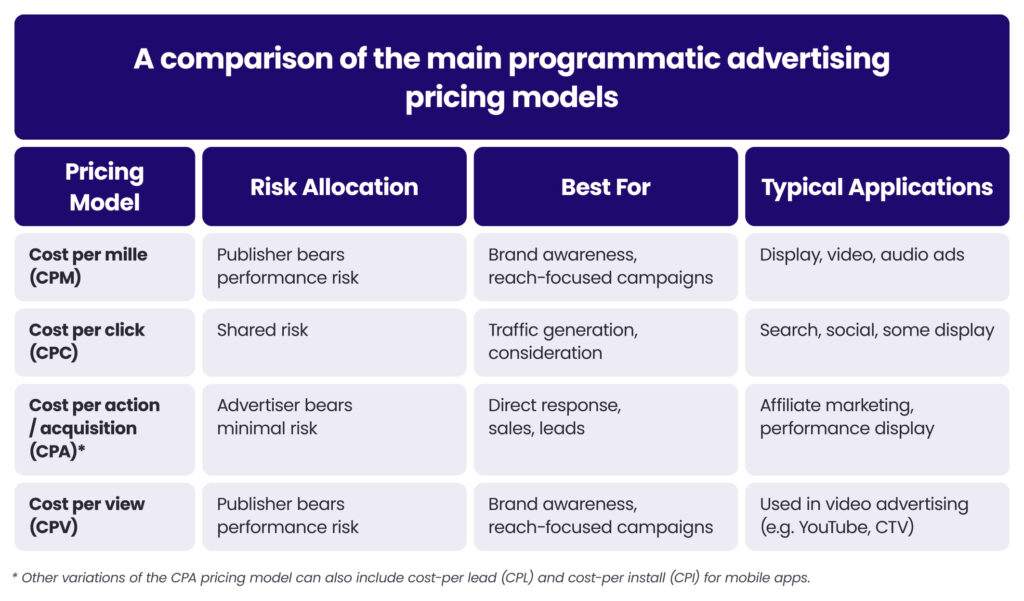

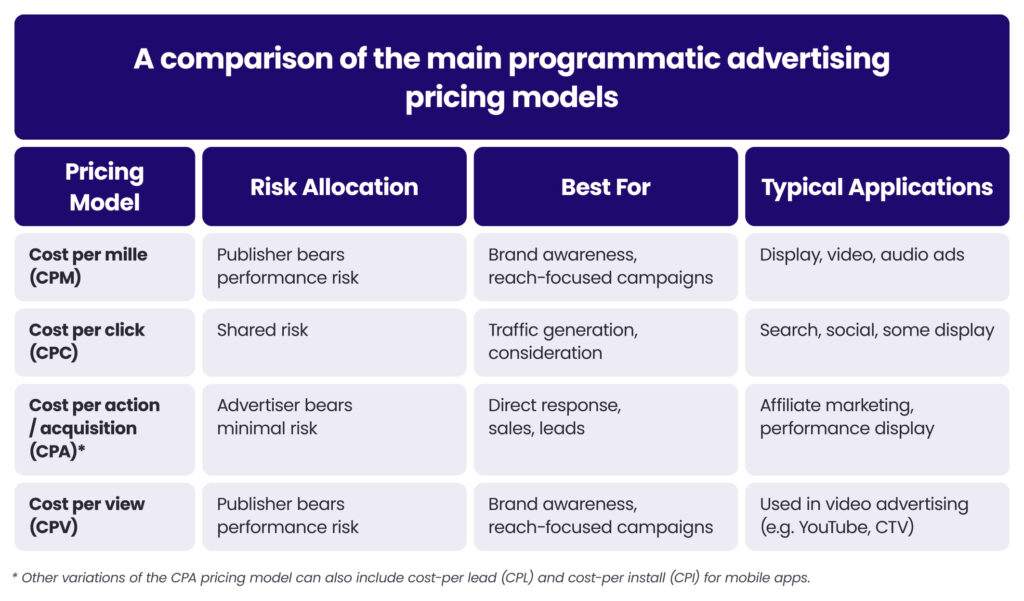

The standard pricing model for impression-based buying is CPM (Cost Per Mille), where advertisers pay for every thousand impressions delivered. CPM rates vary widely based on targeting precision, placement quality, and competition.

How to calculate the CPM

CPM = (Campaign cost ÷ Impressions) × 1,000

For example, if an advertiser spends $10,000 on a campaign that delivers 2,000,000 impressions, the CPM would be:

CPM = ($10,000 ÷ 2,000,000) × 1,000 = $5.00

A similar metric for measuring reach in video advertising, e.g. on YouTube and in CTV environments, is cost per view (CPV).

With the CPV pricing model, advertisers pay when a video ad is viewed (usually by a set duration, e.g. 30 seconds).

How to calculate the CPV

CPV = Campaign cost ÷ video views

For example, if an advertiser spends $20,000 and receives 30,000 clicks, the CPV would be:

CPV = $20,000 ÷ 30,000 = $0.67 per view

Click-based metrics

Clicks measure direct user response to ads, indicating active engagement:

- Clicks: The total number of times users clicked on an ad.

- Click-through rate (CTR): The percentage of impressions that resulted in clicks (clicks ÷ impressions × 100).

- Cost per click (CPC): The average cost paid for each click.

CPC pricing models charge advertisers only when users click on their ads, making it popular for performance-focused campaigns, particularly in search advertising. Under this model, advertisers bid on how much they’re willing to pay for a click, and the actual CPC is often determined through auction dynamics.

How to calculate the CPC

CPC = Campaign cost ÷ Clicks

For example, if an advertiser spends $5,000 and receives 10,000 clicks, the CPC would be:

CPC = $5,000 ÷ 10,000 = $0.50 per click

Conversion-based metrics

Conversions track when users complete desired actions after ad exposure:

- Conversions: Total number of completed desired actions (purchases, sign-ups, downloads, etc.).

- Conversion rate: The percentage of clicks or impressions that result in conversions.

- Cost per action/acquisition (CPA): The average cost to generate one conversion.

- Return on ad spend (ROAS): Revenue generated divided by advertising spend.

The CPA pricing model means advertisers pay only when conversions occur, aligning costs directly with outcomes. This model shifts risk from the advertiser to the publisher, resulting in higher prices per action compared to CPM or CPC models.

How to calculate the CPA

CPA = Campaign cost ÷ Conversions

For example, if an advertiser spends $20,000 and receives 400 conversions, the CPA would be:

CPA = $20,000 ÷ 400 = $50 per conversion

Other variations of the CPA pricing model can also include cost-per lead (CPL) and cost-per install (CPI) for mobile apps.

Pricing model comparison

Each pricing model allocates risk differently between advertisers and publishers:

Most programmatic campaigns use CPM pricing at the media-buying level, even when advertisers measure success by CPC or CPA internally.

This is because RTB ad platforms typically operate on an impression-based auction system, though optimisation algorithms often work to achieve click or conversion goals within CPM buying models.

Advanced measurement concepts

As digital advertising has matured, measurement has evolved beyond basic metrics to more sophisticated approaches that better capture advertising’s true impact.

Multi-touch attribution (MTA)

Multi-touch attribution recognises that customer journeys typically involve multiple touchpoints before conversion. MTA models attempt to distribute credit across these touchpoints rather than assigning all value to a single interaction, like the last click.

Common MTA models include:

- Linear: Equal credit to all touchpoints in the conversion path

- Time decay: More credit to touchpoints closer to conversion

- Position-based: Specific weightings for first touch, last touch, and middle interactions

- Algorithmic: Machine learning-based allocation based on observed patterns

While more sophisticated than single-touch models, MTA faces challenges from cookie limitations, walled gardens, and cross-device journeys.

Incremental and lift studies

Incremental measurement aims to isolate advertising’s true impact by determining what would have happened without ad exposure.

Methods include:

- Randomised controlled trials: Exposing a test group to ads while a control group sees no ads or public service announcements.

- Ghost bids: Participating in auctions without showing ads if won.

- Geographic testing: Varying ad pressure across similar geographic areas.

- Pre/post analysis: Measuring changes in behaviour after campaign launch.

These approaches help advertisers understand advertising’s causal impact rather than merely correlational relationships.

Marketing mix modelling (MMM)

Marketing mix modelling uses statistical analysis to determine how various marketing channels (including digital) contribute to business outcomes.

Unlike attribution, MMM:

- Takes a top-down approach looking at aggregate data

- Incorporates external factors like seasonality, competition, and economic conditions

- Typically analyses longer time periods (months or years)

- Can include both online and offline marketing channels

MMM is experiencing renewed interest as user-level tracking becomes more challenging, offering a privacy-friendly approach to measurement.

The future of media buying and measurement

The digital advertising landscape continues to evolve rapidly, driven by technology advancements, privacy regulations, and changing consumer behaviours.

Several trends are shaping the future of media buying and measurement:

Privacy-first measurement

As third-party cookies disappear and device identifiers become less available, the industry is developing privacy-centric measurement approaches:

- Aggregate reporting: Moving from user-level to group-level measurement.

- Privacy sandboxes: Proposals like Google’s Privacy Sandbox aim to enable measurement without cross-site tracking.

- Data clean rooms: Secure environments where first-party data can be matched without raw-data sharing.

- Machine learning models: Probabilistic measurement leveraging patterns rather than individual tracking.

These approaches prioritise user privacy while still providing actionable insights for advertisers.

AI-driven optimisation

Artificial intelligence is transforming how campaigns are bought, optimised, and measured:

- Predictive bidding: AI models that predict conversion likelihood and optimal bid amounts.

- Creative performance forecasting: Predicting which ad creatives will perform best before deployment.

- Automated budget allocation: Dynamically shifting spend across channels based on performance.

- Anomaly detection: Identifying unusual patterns that might indicate fraud or measurement issues.

These AI capabilities are making programmatic buying more efficient and effective while reducing the need for manual optimisation.

Unified measurement across channels

The industry is working toward more holistic measurement frameworks that combine the strengths of different approaches:

- Cross-media measurement: Initiatives like the World Federation of Advertisers’ framework aim to standardise measurement across digital and traditional channels

- Hybrid attribution models: Combining user-level attribution with marketing mix modelling

- Identity graphs: Building connections between different identifiers while respecting privacy

These unified approaches aim to provide a more complete picture of advertising effectiveness across the entire customer journey.

Conclusion

The evolution of media buying and measurement reflects digital advertising’s ongoing maturation. From manual insertion orders to RTB auctions executed in milliseconds, the industry has continuously innovated to improve efficiency, precision, and accountability.

Today’s advertisers have unprecedented options for how they buy media—from guaranteed placements to real-time auctions, from open exchanges to private marketplaces. These options, combined with sophisticated measurement frameworks, enable more effective advertising than ever before.

However, measurement challenges remain, particularly as privacy considerations reshape what’s possible. The most successful advertisers will be those who adapt to these changes, embracing new approaches that balance marketing effectiveness with consumer privacy.

As we move forward, emerging channels like connected TV, digital audio, and immersive media will continue to expand advertising possibilities while introducing new measurement complexities.

The fundamental principles of effective measurement accuracy, actionability, and attribution will remain essential even as the technical implementation evolves.

Download the PDF & join our waiting list

Fill in the form to download the PDF version and get notified when the next chapters are released.