AdTech Predictions for the Year Ahead [2026]

The programmatic advertising and AdTech industries enter the new year at a moment of transformation, with AI set to continue being the word on everyone’s lips. However, it won’t be the only key theme of 2026.

The past year saw walled gardens doubling down on AI-powered campaign models, companies accelerating their adoption of cookieless technologies, and the emergence of early agentic frameworks that promise a more autonomous future for programmatic advertising.

Although these topics will continue to shape the industry in 2026, we’ll also see more brands and publishers begin building their own AdTech platforms, retail media networks continue their explosive growth, and CTV advertising becoming increasingly embedded within streaming experiences.

To help us make sense of the year ahead, we asked some key people from Spyrosoft Group and Spyrosoft AdTech on how they see these key themes playing out in 2026.

AI will tighten the stronghold of the walled gardens

Michael Sweeney, Head of Marketing at Spyrosoft AdTech

In 2025, Google, Meta, and Amazon each used AI to reinforce their dominance as walled gardens and further reshape how programmatic advertising operates.

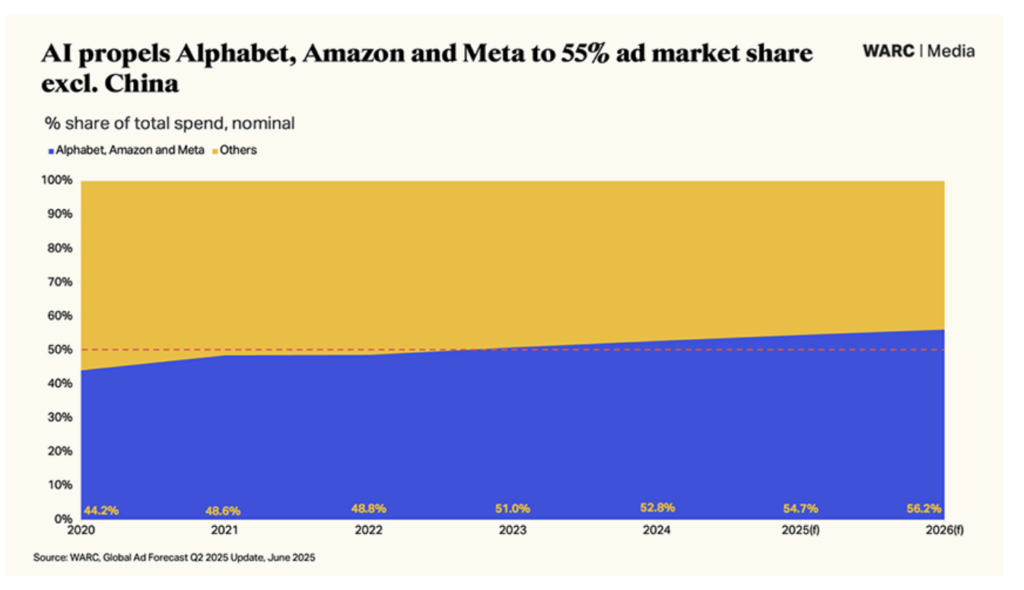

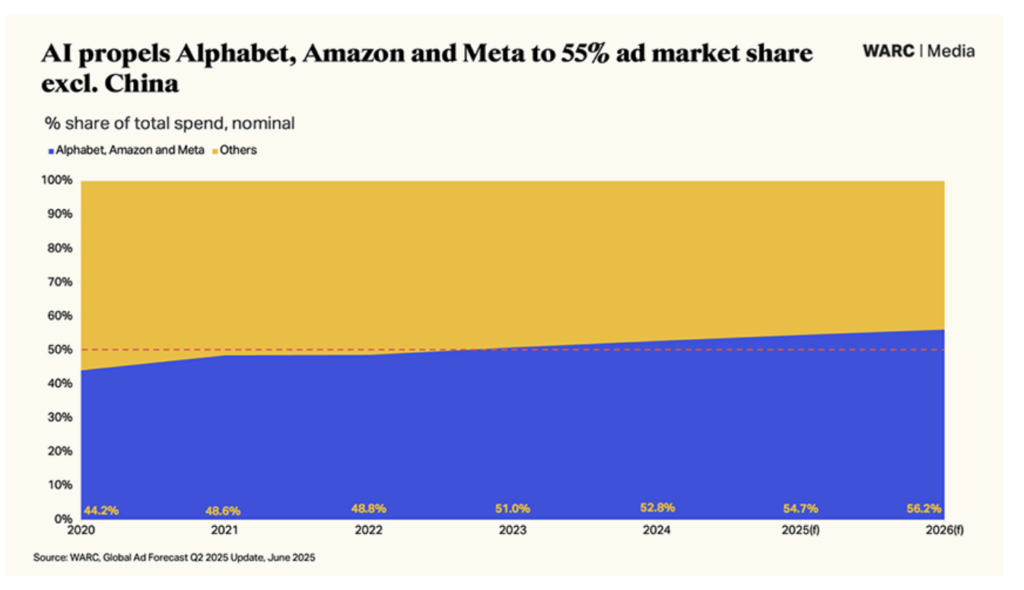

According to WARC’s Global Ad Forecast Q2 2025, Google, Meta, and Amazon collectively accounted for 54.7% of the global digital advertising market (excluding China), representing $524.4 billion. Their combined share is expected to rise to 56.2% in 2026.

With the advancements in their AI-powered AdTech platforms, their dominance of digital ad spend is only set to continue.

Key events from 2025:

- Google balanced major antitrust scrutiny with one of the largest product shifts in its history, pushing advertisers toward AI-led campaign types like Performance Max and AI Max for Search, expanding placements into AI Overviews and conversational Search, and positioning broad-signal optimisation as the new default.

- Meta took a similar path by making Advantage+ automation the starting point for many campaigns.

- Amazon rolled out AI tools like Ads Agent and Creative Agent that automate bidding, audiences, placements, and creative across Sponsored Ads and Prime Video, creating an increasingly unified, full-funnel retail media engine.

These moves set the stage for 2026, when the major platforms are expected to shift from automated media buying to AI-driven media buying—systems that not only optimise campaigns but actively make decisions across channels and formats on the advertiser’s behalf.

What we’ll see in 2026:

- Google will push deeper into signal-based buying, with more premium inventory only fully accessible through AI-forward campaigns, while measurement leans more on modeled conversions and lift tests.

- Meta will double down on Advantage+ as its primary access point, and Amazon’s AI agents will begin orchestrating spend across retail, display, and CTV using its unmatched first-party data.

- Amazon will deepen its AI integration in 2026, emphasising agentic tools for full-funnel automation, creative generation, and programmatic buying across retail media and streaming.

For advertisers and the open-web ecosystem, this means more spend flowing into closed platforms, greater reliance on first-party data and clean rooms, and a shift in human roles away from line-item optimisation and toward creative, experimentation, and strategic oversight.

In the post-cookie era, companies will build diversified identity and measurement strategies

Radosław Kostecki, Business Unit Director at Spyrosoft AdTech

In 2025, the cookieless topic in programmatic advertising matured from crisis anticipation to adoption.

Key events from 2025:

- After many announcements and delays, Google Chrome was expected to shut down support for third-party cookies in 2025. However, in April 2025, Google Chrome announced that it would be abandoning its plans to phase out third-party cookies and retiring many of the key technologies in its Privacy Sandbox initiative.

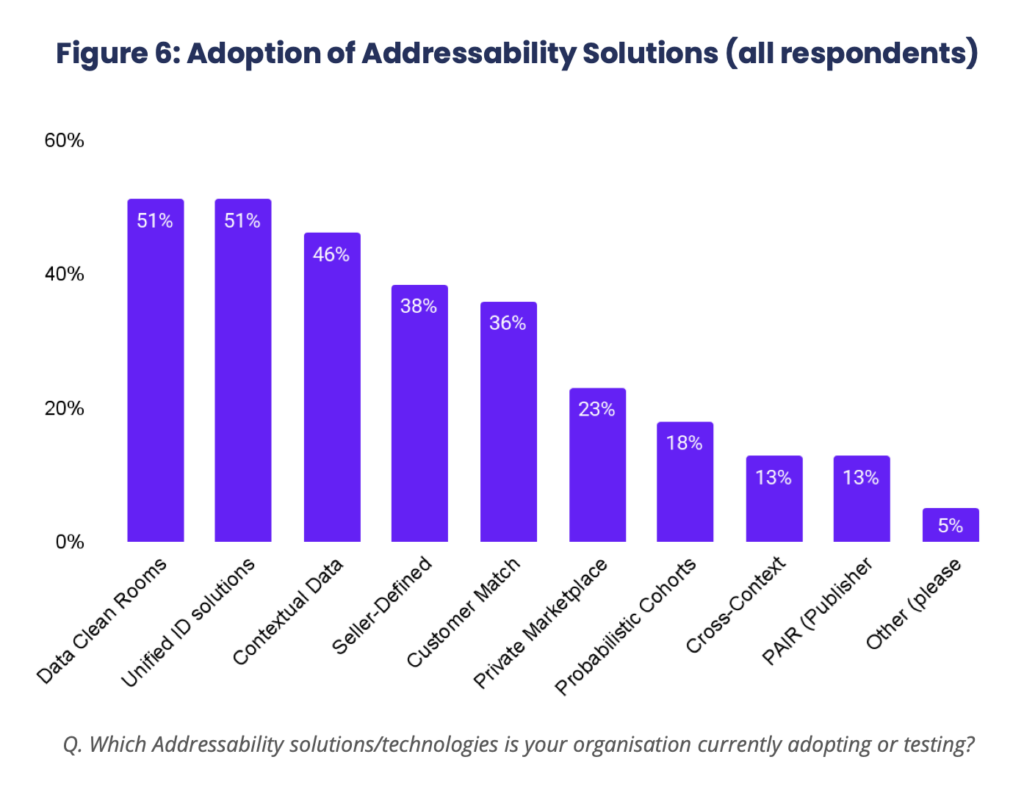

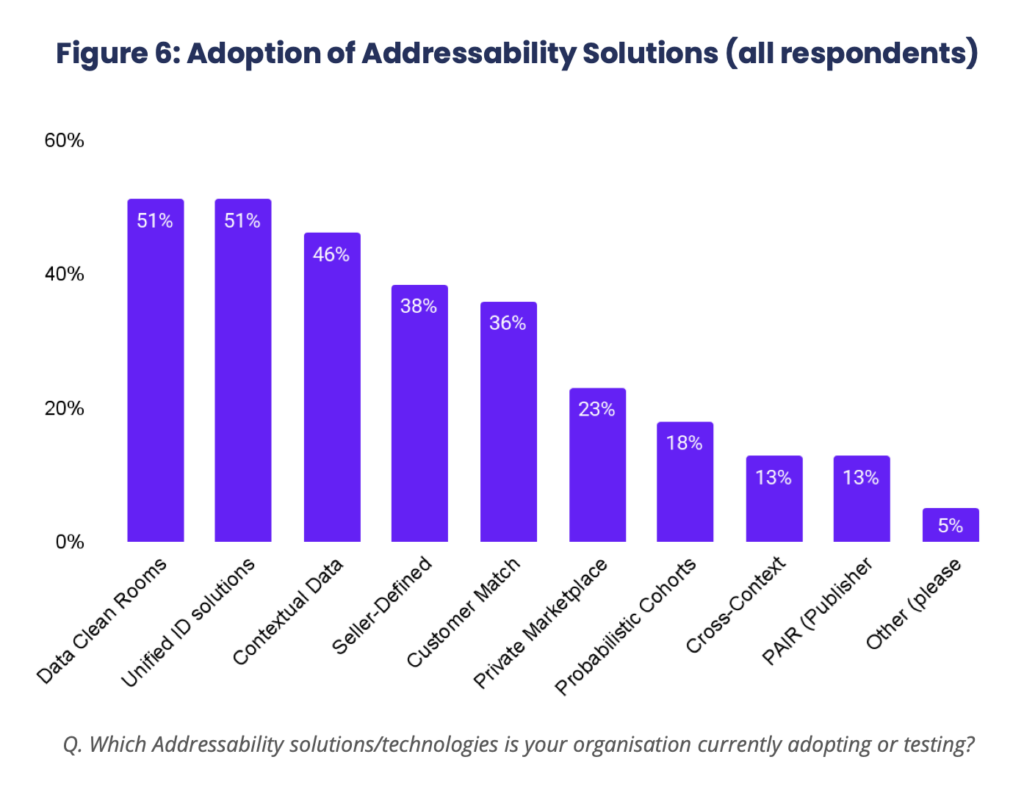

- Companies increased their investments and adoption of alternatives to third-party cookies, with unified IDs and data clean rooms leading the charge.

- Apple continued to restrict device fingerprinting with its releases of Safari 26 and iOS 26.

Although Google Chrome’s plans to phase out third-party cookies and introduce its Privacy Sandbox initiative didn’t materialise, the move away from third-party cookies towards first-party identifiers and privacy-first solutions will continue.

In 2026, the shift moves from losing cookies to operating confidently without them.

What we’ll see in 2026:

- Expect wider adoption of publisher first-party data solutions, retailer identity graphs, and clean-room–based measurement as advertisers look for stability across fragmented environments.

- Identity alternatives—like UID2, RampID, and curated audiences—will mature, but will remain patchworks rather than a unified solution.

- Companies will continue to navigate the data clean room space and explore existing solutions like LiveRamp, InfoSum, and Decentriq – as well as look at how they can build their own solutions with AWS Clean Rooms and Azure Confidential Clean Rooms.

According to IAB Europe’s 2025 Adoption of Addressability & Measurement Solutions report, the most commonly used addressability solutions are data clean rooms (51%), unified IDs (51%), contextual data (46%), and seller-defined audiences (38%).

For brands, AdTech vendors, publishers, and agencies, 2026 becomes less about finding “the” replacement for cookies and more about building diversified identity and measurement strategies—balancing first-party data, contextual and AI-driven prediction, incrementality testing, and data clean rooms to keep performance stable even as identity signals continue to erode.

How much control will companies give to agentic AI systems?

Paweł Wacławczyk, CTO at Spyrosoft AdTech

In 2025, agentic AI moved from theory to early reality in programmatic advertising, reshaping expectations of how media buying could work.

Key events from 2025:

- The release of the Ad Context Protocol (AdCP) created the first credible blueprint for an agentic advertising workflows.

- The IAB Tech Lab introduced its Agentic RTB framework (ARF), laying out how autonomous agents could participate in auctions, negotiate terms, and optimise outcomes without constant human intervention.

- Major players began testing practical implementations, including Magnite with its addition of agentic AI to its ClearLine solution and PubMatic’s launch of its agentic optimisation capabilities.

These innovations signalled that agentic AI would not merely extend automation—it would fundamentally redefine where decisions are made and who makes them.

In 2026, this shift is expected to accelerate as agentic systems move from experiments into early production use.

What we’ll see in 2026:

- DSPs, SSPs, and large publishers will expand trials of autonomous bidding, pacing, and negotiation agents, increasingly allowing AI to make micro-decisions previously handled by human traders or static algorithms.

- AdCP will continue gaining attention from companies looking to automate their advertising workflows, while the IAB’s ongoing Agentic RTB work will push the industry toward interoperable standards.

- More companies are likely to follow PubMatic’s lead, embedding agentic modules that optimise supply paths, packaging, reserve prices, creative decisioning, and campaign structure.

For advertisers, this means the programmatic ecosystem will begin operating more like a network of autonomous decision-making systems rather than a series of manual levers.

But the future of agentic AI in AdTech faces several challenges, including:

1. Adoption

AdTech is notorious for its struggles with adoption – whether it’s the latest version of the OpenRTB protocol or privacy-first initiatives like Privacy Sandbox.

The more alternatives there are for an “interoperability framework”, the less likely it is that we’ll end up with a unified solution.

2. Fear of full agentic capabilities

In 2025 we saw a number of GenAI-powered tools and workflows introduced. These tools help increase productivity and reduce mundane and repetitive tasks.

The move towards “full” agentic AI—where the system makes decisions independently—is a different matter, and people will likely remain reluctant to relinquish control when the stakes are high.

Automation will continue to grow, but the real question is how much control we are prepared to cede to AI.

3. ROI

Perhaps one of the least talked about aspects of AI development and adoption is return on investment.

The cost of developing AI-powered tools can be quite high, so companies will need to crunch the numbers and find the areas where the productivity and cost-saving benefits of AI can be truly realised.

Companies will follow Netflix, PayPal, and Instacart down the “build” path

Piotr Banaszczyk, CEO at Spyrosoft AdTech

In 2025, the long-running “rent vs build vs buy” debate in AdTech entered a new phase as major brands reconsidered how much of their advertising technology they were willing to outsource to third parties.

Key events from 2025:

- Netflix rolled out its proprietary AdTech platform, called Netflix Ad Suite (NAS), in over a dozen countries.

- PayPal extended the rollout of its PayPal Ads solution to more countries, including the UK.

In 2026, this trend is expected to intensify as more companies treat AdTech not as a cost centre but as a revenue-generating product line.

What we’ll see in 2026:

- Large consumer platforms will increasingly push beyond rented solutions and invest in custom infrastructure—ad servers, creative systems, measurement engines, and identity frameworks—optimised for their proprietary datasets.

- Others will take a hybrid approach, buying or licensing core components (such as SSP or CDP modules) while building differentiation layers that sit on top.

- The next wave of commerce, payments, and mobility platforms—following the path set by Instacart, PayPal, and Uber—will continue launching their own ad businesses, creating a more fragmented but more innovative AdTech landscape.

- As companies recognise the value of first-party data, they will increasingly pursuing different ways to monetise it via custom software development. We can already see this trend across retail media and entertainment.

For media companies, publishers, brands, and agencies, 2026 will be defined by navigating this new mix of custom walled gardens, retailer media networks, and semi-open programmatic ecosystems—and choosing whether to rent, build, or buy their own capabilities in response.

The rise of interactive CTV ads: Where commerce meets content

Bartłomiej Lozia, CEO at Spyrosoft BSG

In 2026, the success of shoppable TV won’t be measured by creative flair, but by the engineering precision that turns a viewer’s impulse into a frictionless transaction.

The explosive growth of retail media in 2025—cited in this very article as the fastest-growing digital channel and a market expected to see spend overtake linear and connected TV in 2026—set the stage for the next evolution: making the TV screen a direct point of sale.

As platforms like YouTube and major retailers began rolling out mainstream shoppable ad formats, the industry quickly learned a hard lesson.

The initial wave of interactive ads was often plagued by latency and clunky user experiences, proving that a brilliant concept is worthless if the underlying technology can’t deliver a seamless, millisecond-perfect interaction.

Key events from 2025:

Shoppable ads went mainstream, exposing technical gaps: Major platforms and retailers expanded in-ad checkout options, as highlighted in market analyses. However, reports on user experience indicated that significant latency between the on-screen content and the interactive overlay often led to high drop-off rates, undermining ROI.

Retail media data began powering CTV advertising: As noted by sources like IAB Europe, brands started leveraging first-party retailer data to serve highly targeted ads on connected TV (CTV). This created a massive opportunity but also exposed the inability of legacy ad-serving protocols to sync real-time user interactions with backend commerce systems effectively.

Industry leaders shifted to API-first architectures: To combat latency, forward-thinking brands began bypassing traditional ad tech vendors. They started building “custom bridges” directly between their video players and e-commerce backends, demonstrating that an API-first approach was the only way to deliver the speed required for high conversion rates.

What we’ll see in 2026:

1. Evolution from “headless player” to “smart signal architecture”

Investments in “headless” architectures will accelerate, but the center of gravity will shift from the presentation layer itself to signal intelligence. Thanks to advances in Computer Vision, metadata about products and objects will no longer be an external overlay, but will be “embedded” directly into the video stream.

The player will cease to be just an image renderer and will become an interpreter of a data-rich signal, where every frame carries contextual information about visible objects. This will allow for the instant triggering of interactions without the need for manual content tagging.

2. The player as an aI-driven e-commerce terminal

The video player will be redefined as an intelligent e-commerce frontend, reacting to what the algorithm “sees.”

Vision models will identify products in real-time, automatically linking them with inventory levels and payment gateways.

Instead of treating the player as a media component, winning companies will utilise it as a fully integrated point of sale (POS), where the image itself serves as the product catalog.

3. Infrastructure cost as a new market filter

Although image recognition technology is already available, the key challenge in 2026 will not be “is it possible,” but “at what cost.”

Mass processing of video by advanced neural network models (inference) generates enormous infrastructure costs. Therefore, the market will focus on optimisation—the battle to lower the cost-per-minute of inference.

The advantage will go to entities that find a balance between object detection precision and cloud computing efficiency, or effectively transfer part of the computer vision processing to user end-devices (edge computing) to bypass the server cost bottleneck.

4. “Latency-to-context” as the new success metric

The key performance indicator will become the time that elapses from the moment an object appears on screen to its identification and availability for purchase.

Success will be measured by the fluidity with which the infrastructure can process a “raw” image into an interactive commercial offer, minimising friction resulting from computing power limitations.

Retail media’s next stage of growth will be technology driven

Andrew Radcliffe, Managing Director at Spyrosoft UK

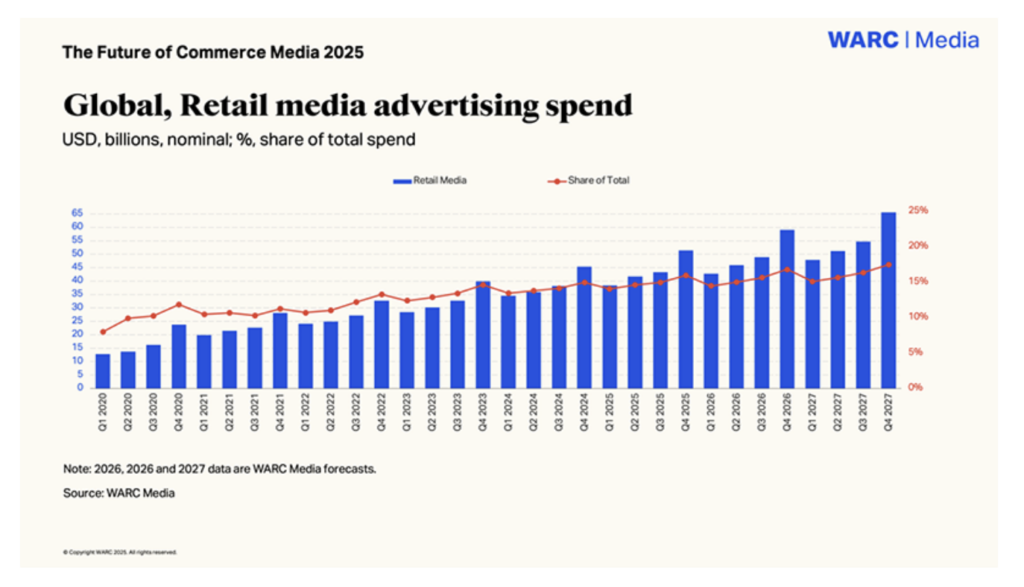

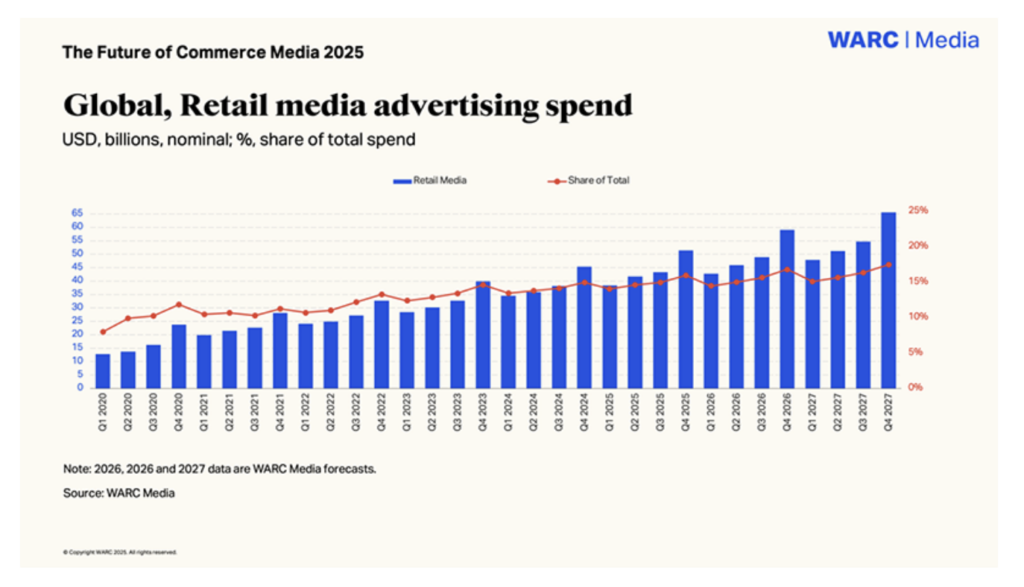

Retail media was the fastest-growing digital channel in 2025, spurred on by the growth of retail media networks (RMNs) from large retailers and commerce companies like Amazon, Walmart, Instacart, and Target.

Although retail media growth has been strong in the US, the real opportunity lies in the UK and Europe.

Key points from 2025:

- Walmart’s retail media business grew around 30% in 2025.

- Investments in retail media are forecast to overtake linear and connected TV spend in 2026.

- The retail media market in Europe is expected to grow four times faster than the wider digital advertising sector.

This suggests that investments and ad spend in retail media are set to continue in the coming years, with many opportunities available for retailers to capitalise on regardless of the maturity of their offering.

What we’ll see in 2026:

- More retailers launching ad networks: Expect grocery chains, commerce companies, and even airlines to enter the space, leveraging their first-party customer data to sell targeted ads.

- Shoppable ads go mainstream: With TikTok, YouTube, and Instagram expanding in-ad checkout options, brands will prioritise direct-response campaigns that drive purchases instantly.

- Retail media networks will mature: Retailers will look to grow their retail media offerings by developing new tools and features to differentiate their RMN and gain a bigger share of ad spend.

- Retail media goes off-site and in-store: According to IAB Europe’s Attitudes to Retail Media Report 2025, retailers generated just 9% of their ad revenue from off-site and 14% from in-store advertising. In 2026, we can expect to see these figures increase as brands use retailer data to serve ads across the open web, social, and connected TV (CTV) to reach high-intent shoppers beyond the retailers’ websites.

Retail media will be one of the most lucrative growth areas for the programmatic advertising industry, shifting ad budgets away from traditional display and search advertising.

But despite the growth we’ve seen from the large retailers and their retail media offering, we’re still very much in the opening chapter of the retail media story – especially in the UK and Europe.

The next chapter of the retail media story, which will play out over the next 12 months, will focus on growth via technology.

The retailers that succeed in growing their retail media business will be the ones that invest in technological innovation, optimising inefficiencies, and developing custom features that deliver a competitive advantage.

Contextual targeting will continue its upward trajectory

Jacek Jagiełło, Senior Solution Architect at Spyrosoft AdTech

The contextual ad targeting market continues to grow year over year and is expected to reach $550 billion by 2033.

Contextual ad targeting delivers ads based on the content a user is currently consuming, rather than relying on personal identifiers. This approach enables relevant advertising while also providing strong privacy controls as it doesn’t require the use of personal data.

Although this targeting method dates back to the early days of digital advertising, it is experiencing a resurgence due to the ever-changing privacy landscape.

Key events from 2025:

- Google scaled back the Privacy Sandbox initiative, prompting many marketers to reconsider contextual targeting as a viable alternative to identity-based approaches.

- Amazon launched AI-powered Contextual Pause Ads, which dynamically align ad messaging with on-screen content using AI-driven analysis.

- According to GumGum research, 94% of consumers across the US, UK, and Canada prefer contextual ads over ads based on browsing history.

What we’ll see in 2026:

- Greater adoption of contextual CTV: As more streaming inventory is sold programmatically and household-level IDs remain constrained, advertisers will increasingly target content—not individuals.

- Hybrid “context + first-party data” strategies: The most effective approaches will combine publisher first-party data with contextual signals, enabling privacy-safe prospecting on the open web while still supporting ID-based optimisation where consented data is available.

- Growth in real-time contextual signal providers: More data providers will offer richer and more dynamic contextual signals to help advertisers align campaigns with the environments users engage with. Major live events—such as sports, concerts, and product launches—will increasingly be activated primarily through contextual targeting signals.